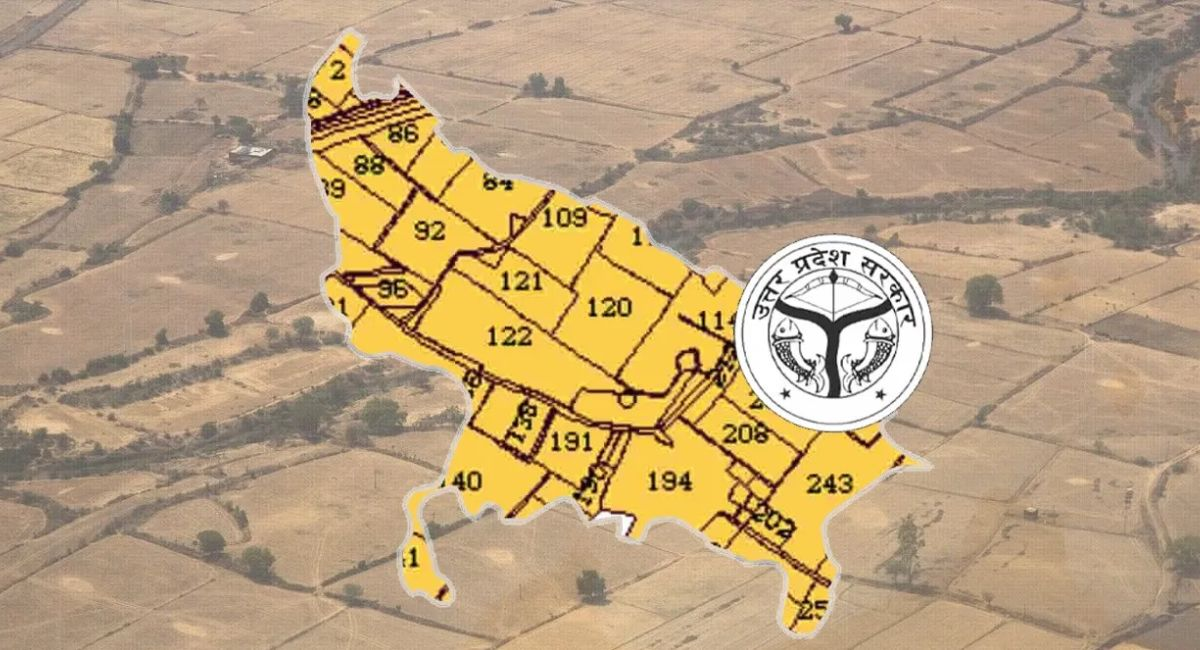

Investing in real estate is often considered a safe and lucrative opportunity, but safety and precision in transactions are key, especially in regions like Uttar Pradesh (UP). One tool that emerges as indispensable for real estate buyers in UP is the Bhu Naksha UP. This digital interface facilitates a secure and transparent property transaction process by providing detailed maps and land record information—ultimately ensuring that transactions are conducted without any underlying risks of fraud or misrepresentation.

Understanding Bhu Naksha UP

Bhu Naksha UP is an online geographic information system (GIS)-based portal provided by the Government of Uttar Pradesh. It offers valuable insights regarding land parcels by displaying digitized maps and detailed plot information. This tool is crucial for verifying land details and ensuring transparency and security in real estate dealings. It helps buyers in areas like property validation, ownership clarity, and assessment of physical aspects of the land.

Primary Features

- Land Ownership Verification: Bhu Naksha UP allows users to check and verify the legitimacy of land ownership, thus preventing any potential instances of disputes or fraud.

- Detailed Land Maps: The portal provides extensive land maps, helping buyers understand the geographical layout and boundaries of the property.

- Legal Assurance: By validating through official and updated records, it minimizes the risk of legal issues concerning land ownership.

- Accessibility: Accessible from anywhere with an internet connection, it offers a user-friendly interface for quick and easy navigation of land records and maps.

Utilization for Safe Transactions

To harness the benefits of Bhu Naksha UP for safe transactions, buyers should integrate this platform into their property acquisition process. Here’s how:

- Pre-purchase Verification: Before finalizing a transaction, buyers should access Bhu Naksha UP to verify the property details including the owner’s information and land boundaries. This step assures that what is being promised by the seller corresponds with official records.

- Post-purchase Validation: Upon acquisition, verifying through Bhu Naksha UP ensures the property aligns with the stipulated legal framework, thereby fortifying the buyer’s security against illicit claims.

- Cross-reference with Financial Options: Real estate buyers can leverage this platform alongside financing initiatives like the Bajaj Housing Finance Home Loan for seamless transactions.

Benefits of Bajaj Housing Finance Home Loan

When considering financing options for property purchases, the Bajaj Housing Finance Home Loan emerges as a proficient choice due to its array of benefits tailored to meet individual needs and financial capabilities.

Significant Benefits

- Competitive Interest Rates: Bajaj Finserv offers borrowers attractive interest rates, making home loans cost-effective and accessible.

- Flexible Repayment Options: Choose from various repayment setups to cater to your financial situation, enabling a smoother loan experience.

- High Loan-to-Value Ratios: Offers up to 80%-90% of the property value, ensuring that buyers need not invest too much upfront capital.

- Top-up Loans: Existing customers can benefit from top-up loan facilities in case of additional financing needs, easing financial strains.

- Minimal Documentation: Simplified documentation process makes it easier and quicker to secure loans.

Additional Info: Downloading the Bajaj Finserv App gives you quick access to a wide range of financial services, making it simple to manage your finances anytime, anywhere. To enjoy a seamless experience, ensure your device is compatible and take a moment to review the app’s terms and conditions. This helps guarantee a hassle-free and efficient use of all its features.

How To Apply for Bajaj Housing Finance Home Loan

Applying for a Bajaj Housing Finance Home Loan is streamlined and efficiently tailored for prospective borrowers, ensuring a smooth and less cumbersome procedure.

Steps to Apply

- Eligibility Check: Before applying, check the eligibility criteria outlined by Bajaj Finserv to ensure compliance with the basic requirements such as income levels and credit scores.

- Online Application Visit: Bajaj Finserv’s Home Loan Page and fill out the online application form. Provide necessary details such as personal, employment, and property information.

- Documentation: Compile and submit required documents which typically include identity proof, address proof, income statements, and property-related papers.

- Approval: After submission, the team at Bajaj Finserv begins evaluating your application and confirming eligibility. Upon successful evaluation, the loan is disbursed.

- Loan Disbursement: Post-approval, the loan amount is disbursed to your account enabling you to proceed with your property purchase or investment.

Integrating Real Estate Finance with Bhu Naksha UP

By utilizing Bhu Naksha UP to verify property details and integrating Bajaj Housing Finance’s loan benefits, buyers can create a robust and secure framework for real estate transactions. The transparency offered by Bhu Naksha UP combined with the financial security provided by Bajaj Finserv Home Loans ensures that buyers can navigate the real estate landscape with assurance and confidence, reducing risks and maximizing benefits.

In summary, Bhu Naksha UP serves as a pivotal tool for land validation, while Bajaj Housing Finance Home Loan provides the backbone for financing. Together, they offer a comprehensive solution for real estate buyers looking to ensure safe and beneficial transactions in Uttar Pradesh. Whether you’re looking to verify land details or secure financing, these resources provide optimal support for your real estate endeavors.